AI IN BANK l LATEST IN 2021

AI in bank Operations Service

Artificial Intelligence (AI) has revolutionized various industries, and the banking sector is no exception. The integration of AI technologies in bank operations has brought about significant transformations, enhancing efficiency, improving customer experiences, and revolutionizing decision-making processes. In this article, we explore the role of operations and its impact on the future of banking.

Customerand Personalization:

AI-powered chatbots and virtual assistants have become essential tools in delivering exceptional customer . These intelligent systems can handle customer inquiries, provide real-time assistance, and offer personalized recommendations. By leveraging natural language processing and machine learning algorithms, AI enables banks to offer round-the-clock customer support, enhancing customer satisfaction and engagement.

Fraud Detection and Security:

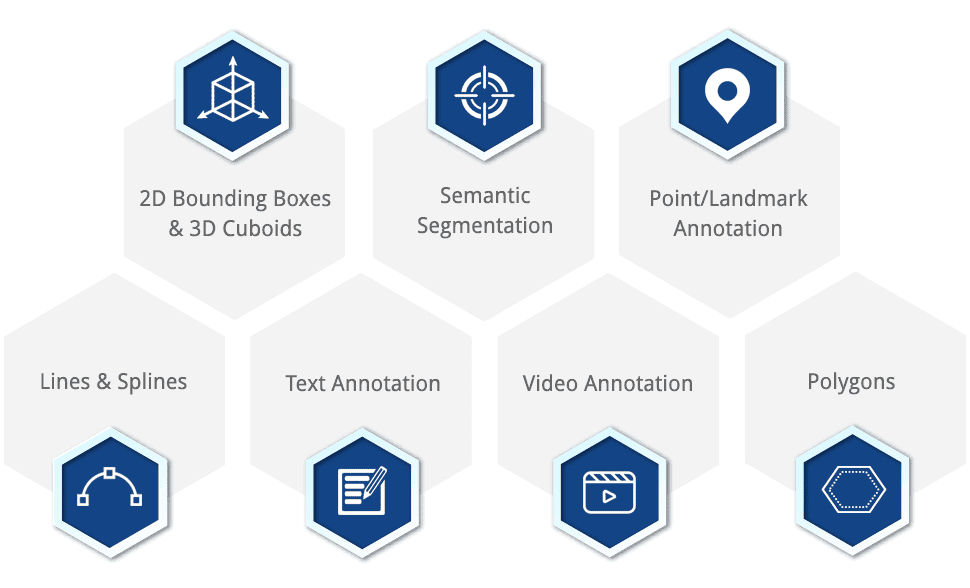

AI plays a critical role in enhancing bank security and fraud detection. Machine learning algorithms analyze large volumes of data to detect patterns, anomalies, and potential fraud cases. AI systems can identify suspicious transactions, flag fraudulent activities, and promptly alert bank officials. This proactive approach to security ensures the protection of customer accounts and helps banks stay one step ahead of fraudsters.

Risk Assessment and Compliance:

AI algorithms enable banks to automate risk assessment processes and ensure compliance with regulatory requirements. Machine learning models can analyze vast amounts of data to identify potential risks, assess creditworthiness, and make informed lending decisions. AI systems also help banks monitor transactions for money laundering and other illicit activities, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

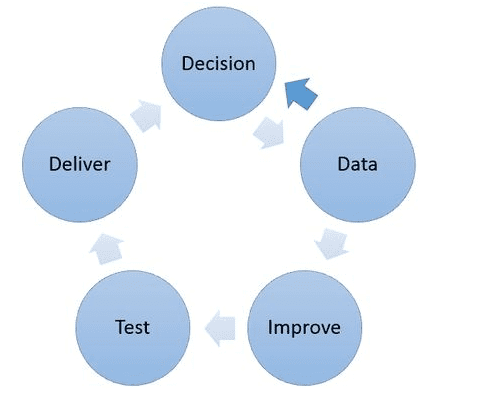

Efficient Data Analysis and Decision-Making:

Banks generate enormous volumes of data, and AI excels in analyzing and extracting insights from this data. AI algorithms can process and analyze data at a rapid pace, identifying trends, predicting customer behavior, and enabling data-driven decision-making. This enables banks to offer personalized product recommendations, optimize pricing strategies, and improve overall operational efficiency.

Process Automation:

AI technology streamlines bank operations by automating repetitive tasks and workflows. Robotic process automation (RPA) systems can perform routine tasks such as data entry, document processing, and report generation, freeing up human employees to focus on more complex and value-added activities. Process automation reduces errors, enhances operational efficiency, and accelerates turnaround times.

Enhanced Risk Management:

AI-powered risk management systems help banks assess and mitigate risks more effectively. Machine learning algorithms can analyze market data, customer behavior, and other relevant factors to predict and manage potential risks. These systems provide early warnings, identify vulnerabilities, and enable banks to proactively address risks, ultimately enhancing financial stability and resilience.

Improved Customer Insights and Marketing:

AI enables banks to gain deeper insights into customer behavior, preferences, and needs. By analyzing customer data and transaction history, AI algorithms can identify patterns, segment customers, and develop targeted marketing campaigns. This level of personalization enhances customer experiences, increases engagement, and boosts cross-selling and upselling opportunities.

AI technology has transformed bank , paving the way for a more efficient, secure, and customer-centric banking experience. From customer and fraud detection to risk assessment and decision-making, AI offers unprecedented opportunities to enhance operational efficiency and deliver personalized By harnessing the power of AI, banks can unlock valuable insights, streamline processes, and stay ahead of the competition in the fast-paced digital era. As AI continues to evolve, it will play an increasingly crucial role in shaping the future of banking, enabling banks to adapt to changing customer demands, mitigate risks, and deliver innovative solutions that meet the needs of the modern digital consumer.

How are Banks Best Capturing the AI Opportunity?

Artificial Intelligence (AI) has emerged as a game-changer for the banking industry, revolutionizing improving customer experiences, and driving innovation. To fully capitalize on the AI opportunity, banks are adopting various strategies and approaches. In this article, we explore how banks are best capturing the AI opportunity and leveraging its potential to transform the way they operate.

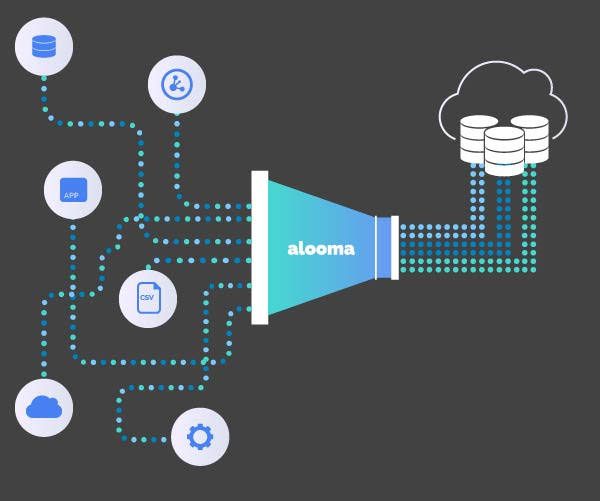

Building a Data-Driven Culture:

To effectively harness the power of AI, banks are prioritizing the development of a data-driven culture. They are investing in data infrastructure, data management, and data governance to ensure the availability of high-quality data. By leveraging advanced analytics and AI technologies, banks can derive valuable insights from vast amounts of data, enabling better decision-making, personalized customer experiences, and improved operational efficiencies.

Collaborating with Fintech Startups:

Banks are increasingly collaborating with fintech startups to access cutting-edge AI technologies and expertise. This collaboration allows banks to tap into the innovative capabilities of startups that specialize in AI solutions for the financial sector. By partnering with fintech companies, banks can accelerate their AI adoption, enhance their offerings, and deliver advanced solutions to their customers.

Implementing Robotic Process Automation (RPA):

Robotic Process Automation (RPA) is an integral part of banks’ AI strategies. RPA technology automates repetitive and rule-based tasks, freeing up employees to focus on higher-value activities. By implementing RPA, banks can streamline processes, reduce errors, enhance operational efficiency, and improve customer service. RPA also enables seamless integration with AI technologies, such as chatbots and virtual assistants, to deliver enhanced customer experiences.

Enhancing Customer Experiences with AI:

Banks are leveraging AI to deliver personalized and seamless customer experiences. Chatbots and virtual assistants powered by natural language processing (NLP) provide round-the-clock customer support, answer queries, and offer personalized recommendations. AI algorithms analyze customer data to understand preferences, anticipate needs, and provide tailored financial products and. By leveraging AI, banks can deliver exceptional customer experiences, enhance satisfaction, and build long-term customer loyalty.

Strengthening Security and Fraud Detection:

AI plays a crucial role in strengthening security and fraud detection in banking. Machine learning algorithms analyze vast amounts of data to detect patterns, anomalies, and potential fraud cases. AI systems can identify suspicious transactions, flag fraudulent activities, and prevent security breaches. By leveraging AI for security and fraud detection, banks can enhance customer trust, protect sensitive data, and ensure regulatory compliance.

Developing Advanced Risk Management Models:

Banks are leveraging AI to develop advanced risk management models. Machine learning algorithms analyze market data, customer behavior, and other relevant factors to predict and manage potential risks. AI-powered risk management systems provide early warnings, identify vulnerabilities, and enable banks to proactively address risks. This helps banks enhance financial stability, manage credit risks, and make data-driven risk management decisions.

Embracing Explainable AI and Ethical Practices:

As banks adopt AI, they are also embracing the importance of explainable AI and ethical practices. Explainable AI ensures that AI models and algorithms are transparent, enabling banks to understand how AI decisions are made. Ethical considerations are taken into account to ensure fairness, privacy, and compliance with regulations. By adopting explainable AI and ethical practices, banks build trust with customers, regulators, and stakeholders, fostering long-term relationships.

Banks are capitalizing on the AI opportunity by building a data-driven culture, collaborating with fintech startups, implementing RPA, and enhancing customer experiences. AI is transforming the way banks operate, from strengthening security and fraud detection to advancing risk management and improving operational efficiency. By leveraging AI technologies and embracing explainable AI and ethical practices, banks are at the forefront of innovation, delivering enhanced and experiences to their customers. The successful adoption of AI enables banks to remain competitive, drive growth, and navigate the rapidly evolving landscape of the financial industry.

Significant Banks are on the ball with regards to embracing AI banking as a business system – a fundamental assignment for any significant association looking for an edge over their rivals.

With the convergence between AI and account simply beginning, investigate how associations are utilizing AI in financial today, and what the appropriation of AI banking systems will mean for key parts of their tasks – to improve things.

Outstanding Applications of AI in Banking Today

Here are four significant use instances of AI and AI in financial tasks up until this point:

Client support

- Client support is a critical component of any business, regardless of its size or industry. It encompasses the processes and provided to clients to ensure their satisfaction, address their needs, and foster long-term relationships. In this article, we explore the importance of client support and how it drives business success.

Customer Satisfaction and Loyalty:

Effective client support is essential for ensuring customer satisfaction and building loyalty. When clients receive prompt and helpful support, it enhances their overall experience and strengthens their trust in the business. Satisfied clients are more likely to become loyal customers, repeat their business, and recommend the company to others. By prioritizing client support, businesses can foster long-term relationships and drive customer loyalty.Problem Resolution and Conflict Management:

Client support teams play a crucial role in resolving issues and managing conflicts. When clients encounter problems or have concerns, they need a responsive and efficient support system to address their issues promptly. Skilled support professionals are trained to handle difficult situations, listen to clients’ concerns, and work towards finding satisfactory resolutions. Effective problem resolution and conflict management build trust and demonstrate a commitment to client satisfaction.Relationship Building and Trust:

Strong client support contributes to relationship building and fosters trust between the business and its clients. Regular interactions and open communication with clients build a foundation of trust and credibility. Support professionals who demonstrate empathy, attentiveness, and professionalism can create a positive impression and establish strong connections with clients. These relationships form the basis for long-term partnerships and can lead to additional business opportunities.Feedback and Continuous Improvement:

Client support is an invaluable source of feedback for businesses. Support teams have direct interactions with clients, enabling them to gather insights into their experiences, preferences, and expectations. This feedback provides valuable information for businesses to identify areas for improvement and make necessary adjustments to their products, or processes. By actively seeking and acting upon client feedback, businesses can continuously enhance their offerings and deliver exceptional client experiences.Upselling and Cross-Selling Opportunities:

Well-executed client support opens doors to upselling and cross-selling opportunities. Support professionals who have a deep understanding of clients’ needs and preferences can identify opportunities to recommend additional products or that align with their requirements. By leveraging these opportunities, businesses can not only drive revenue growth but also enhance the value they provide to clients, further strengthening the client-business relationship.Competitive Advantage:

Providing exceptional client support sets businesses apart from their competitors. In today’s competitive landscape, customers have high expectations for support. By delivering timely, personalized, and knowledgeable assistance, businesses can differentiate themselves and gain a competitive advantage. Strong client support can become a key differentiating factor that attracts and retains clients in a crowded marketplace.Business Growth and Referrals:

Client support is closely tied to business growth. Satisfied clients are more likely to continue their business relationships and refer the company to others. Positive word-of-mouth referrals can generate new leads and expand the customer base. A reputation for outstanding client support can position a business as a trusted and reliable partner, attracting new clients and driving sustainable growth.Client support plays a pivotal role in building strong relationships, driving customer satisfaction, and fostering business success. By prioritizing client support, businesses can create positive experiences, address client needs effectively, and build trust and loyalty. Exceptional client support not only ensures customer satisfaction but also leads to business growth, competitive advantage, and enhanced brand reputation. Investing in client support is a strategic decision that pays off in the long run, as it enables businesses to forge meaningful connections with clients and drive sustainable success.

Client support is a fundamental part of banking, and frequently has the greatest effect wherein bank a planned client picks. It’s obvious then that this is a region where banks are testing the most with to upgrade client connections and improve the general client bank association.

Conversational AI is now changing financial client support as accommodating chatbots, which give a more customized on the web and portable financial experience for the client.

Probably the greatest player on this side of the AI in financial scene is Bank of America’s Erica, the first generally accessible remote helper for use in the bank’s portable application.

Remote helpers, supported by AI, utilize prescient investigation to decide the correct pathways to coordinate clients and smooth the way toward drawing in with the bank.

`

`