How to Create an Accounting System in Auto Data Entry in Excel

(Excel Bookkeeping) That You Should Know

You’ll want to start with a template that contains a chart of accountsAuto Data Entry in Excel, transaction sheet, and income statement page if you wish to manage your basic accounting with Excel. You’ll alter this template, save it to your computer, and then record and classify your daily transactions within the document to develop your own Excel bookkeeping system. Many business owners will want to consider investing in bookkeeping or accounting software solutions since performing business bookkeeping in Excel is a laborious and time-consuming operation.

The day-to-day management of your booksAuto Data Entry in Excel—ensuring that you’re monitoring your revenue and spending, reconciling transactions, and recording everything accurately—will be one of the most crucial responsibilities when it comes to your business finances. When it comes to business accounting, bookkeeping is the foundational process that keeps you organized, current, and prepared to tackle any situation.

Having said that, while some business owners prefer to use accounting software or hire a professional Auto Data Entry in Excelbookkeeper if you’re a small or new firm, you may want to construct an excel bookkeeping system using a tool you most likely already have, Microsoft Excel.

Fortunately, Microsoft Excel is quite user-friendly, and there is a choice of templates to help you if you opt to handle your basic bookkeeping with it (or even using Google Sheets). To assist you in getting started, we’ll describe how to handle your small company bookkeeping in Excel, as well as the limits of this spreadsheet system. Finally, we’ll show you how to establish your accounting system in Auto Data Entry in Excel.

What to Expect When Doing Small Business Auto Data Entry in Excel Bookkeeping

Because you probably already have Microsoft Excel installed on your computer, doing your small business bookkeeping with it appears to be a simple way to set up and manage your books—especially if you’re just getting started and don’t have the funds to invest in third-party software or bookkeeping professional. Excel, being a spreadsheet-based tool, may be used for a variety of tasks, including basic accounting and account management; but, it has limitations, particularly when compared to platforms like QuickBooks Online or WaveAuto Data Entry in Excel.

- As a result, while putting together an Excel bookkeeping system, you should be able to:

- Keep track of your “accounts” (the many sorts of transactions you’ll make).

- Transactions should be entered and categorized.

- Create income statements (also known as profit and loss statements) from the transactions you’ve recorded by manually importing data from your list of transactions or using algorithms to import it automatically.

- Keep track of the bills you’ve sent clients and compare them to the transactions you’ve made.

In light of this, Auto Data Entry in Excel, unlike automated bookkeeping software, will not be able to:

- Connect to your company’s bank accounts or credit cards to import and categorize transactions automatically.

- Create standard financial documents automatically using data from your books.

- Errors in data entering will be detected and you will be notified.

- Allow numerous people to operate in your system with ease.

Auto Data Entry in Excel Bookkeeping (Single-Entry)

Because you’ll have to manually input data and handle your basic bookkeeping in Excel, you’ll probably want to utilize the single-entry technique, Auto Data Entry in Excelwhich means you only enter each transaction once, classifying it as either leaving (expense/loss) or entering (profit/income).

more like this, just click on: https://24x7offshoring.com/blog/

Once you’ve completed these transactions, you’ll be able to produce an income statement, which summarises your income and costs for a set period (typically a month) and shows how profitable or profitable your firm is. This accounting approach differs from the double-entry method, in which each transaction is recorded twice, once as a debit and once as a credit.

Although creating a double-entry accounting system in Auto Data Entry in Excelis theoretically doable, we do not recommend it. Maintaining a double-entry system will be difficult, time-consuming, and error-prone, given the manual nature of Excel bookkeeping. If your company expands to the point that double-entry accounting is required, you’ll want to invest in more automated software to manage your money, as we’ll explain later.

How to Make an Auto Data Entry in Excel Bookkeeping System

Let’s talk about what you’ll need to do to develop your system for your small business now that we know a little bit more about what Auto Data Entry in Excel1bookkeeping entails.

- Begin with an Excel sheet template for bookkeeping.

You might be able to create your own bookkeeping Excel file from scratch if you have previous Excel skills. If you don’t have any Excel knowledge or simply want the easiest, quickest method to get started, you can seek and download an Excel accounting template.

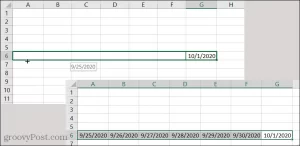

We’ll use an example based on a Bench template for this talk; this template divides your Excel accounting system into three sheets: a chart of accounts sheet, a transactions sheet, and an income statement sheetAuto Data Entry in Excel. You’ll be able to input and classify your transactions, as well as produce income statements, using this document and these three sheets.

If you’d rather use Google Sheets than Excel (they’re quite similar), check out The Spreadsheet Alchemist’s simple profit and loss spreadsheet. Select “File,” then “Make a copy,” and save the Workbook to your computer to utilize this template. Expenses and income are recorded on distinct pages in this worksheet, so you’ll have to manually add up certain transactions and insert them into Auto Data Entry in Excelthe income statement on the P&L Summary tab to construct an income statement.

- Parts of an Excel Bookkeeping System That Are Required

The template we’ll be reviewing is divided into three parts: a chart of accounts, a list of transactions, and an income statement, as we indicated (and as depicted below). Regardless of the type of template you choose or build, these three parts will be necessary for completing basic bookkeeping using Auto Data Entry in Excel.

Continue Reading: https://24x7offshoring.com/blog/